Explain the Differences Between Taxable Income and Adjusted Gross Income

The part of your gross income which is currently subjected to taxes is Taxable Income. Adjusted Gross Income AGI Adjusted gross income is always more than taxable income.

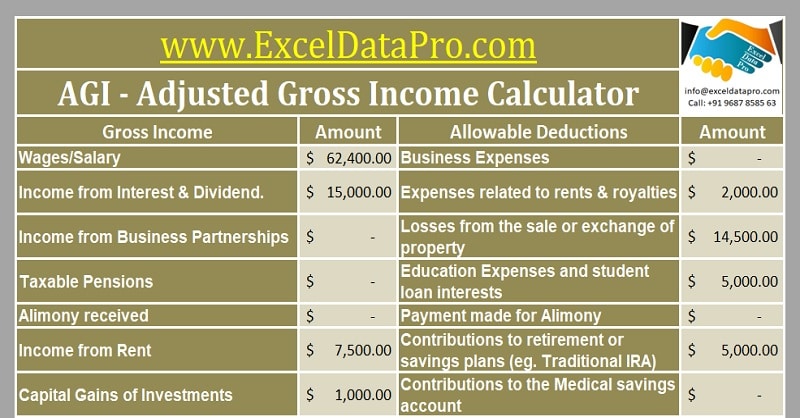

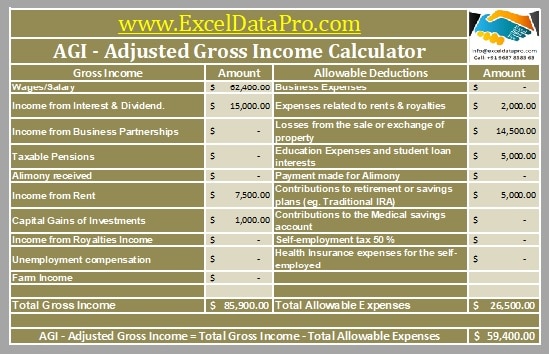

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

It is the total income of any individual minus some specific items.

/tax_shutterstock_584351497-5bfc325b46e0fb00511aeca8.jpg)

. Adjusted gross income is your gross income minus any deductions youre eligible to claim. 6 rows The main difference between taxable income and the adjusted gross income is that Gross. You dont have to master tax terminology to maximize your refund.

Explain one sociological theory or one of the sub-theories that best supports the social problems approach to crime causation and one theory that best supports the social responsibility approach to crime causation and why. Agi is the number used to calculate most. Come tax season youre reminded of just how many.

Explain the differences between taxable income and adjusted gross income. April 1 2021 0 Comments in by admin. Explain the differences between taxable income and adjusted gross income.

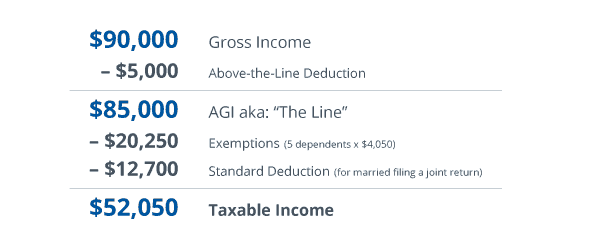

Get Expert Help at an Amazing Discount Share this entry. Your agi is not the income figure on which the irs will actually tax you. Taxable income is a laymans term that refers to your adjusted gross income AGI less any itemized deductions youre entitled to claim or your standard deduction.

Explain the differences between taxable income and adjusted gross income. Looking for a Similar Assignment. Article Sources Investopedia requires writers to use primary sources to support their work.

Explain The Differences Between Taxable Income And Adjusted Gross Income. See the full IRS list here. I just received a tax planning booklet from my CPA and if I am looking at this correctly I am going to pay SUBSTANTIALLY less for 2013 than I did in 2012.

Adjusted gross income is the taxable income of an individual which includes income from all sources. Think of adjusted gross income as gross income minus above the line deductions. Your adjusted gross income agi is just that gross.

Explain the differences between taxable income and adjusted gross income. Before you decide to itemize or take a standard deduction apply above the line deductions to your gross income. Taxable income is the basis of the taxes that are imposed on all taxpayers while adjusted gross income is the basis of the taxes imposed on individuals.

Gross Income contains all money you earn that is not expressly removed from taxation under the Internal Revenue Code IRC. Explain the differences between taxable income and adjusted gross income. Can someone explain the difference between Gross Income and Adjusted Gross Income.

Your agi will almost always be lower than your gross income. May 9 2018 in Term Paper Tutors by admin Explain the differences between. Get Expert Help at an Amazing Discount.

The dollar amount difference between gross income and adjusted gross income can vary based on your available tax deductions but your adjusted gross income is always a lower. Explain the differences between taxable income and adjusted. For a year your Gross Income applies to all your pre-tax.

The model should be simplified as much as possible. Gross income is the total amount of money you make in a year before taxes. The difference between earned income and gross income is an important one in your tax accounting.

Both are derived from the gross income of a taxpayer less all allowable deductions. Taxes are the amount of money individuals and businesses pay to fund state and federal revenue programs and individuals pay a percentage of their gross income each pay period in taxes. Online Assignment Help Explain the differences between taxable.

Explain the differences between taxable income and adjusted gross income. Flow rates qf and q are independently set by external valves and may vary Derive a dynamic model for this process. Explain the differences between taxable income and adjusted gross income.

Gross income and adjusted gross income are some common income tax terms that you may come across on your federal tax return. Explain the differences between taxable income and adjusted gross income. Looking for a Similar Assignment.

The number youre left with is your AGI. When computation of income tax is done it is not the gross income but adjusted gross income that is looked for. To arrive at the number of Taxable Income expenses are deducted from gross income.

And well help you find each. Explain the differences between taxable income and adjusted gross income.

What Is Adjusted Gross Income Agi Nerdwallet

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

/GettyImages-88305470-1--57520b1c5f9b5892e8bfc1a0.jpg)

Adjusted Gross Income Agi Definition

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

Adjusted Gross Income Agi Definition Taxedu Tax Foundation

Standard Deduction Tax Exemption And Deduction Taxact Blog

What Is Adjusted Gross Income Agi Gusto

What Is Adjusted Gross Income Agi Gusto

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

What Is Adjusted Gross Income H R Block

/tax_shutterstock_584351497-5bfc325b46e0fb00511aeca8.jpg)

Taxable Income Vs Gross Income What S The Difference

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Agi Calculator Adjusted Gross Income Calculator

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Calculator Examples With Excel Template

Comments

Post a Comment